There is a gap between the finance community and the movement towards sustainable water use practices. VWI established clear rationale to fill this gap. VWI proceeded to engage the finance community, targeting key organisations with strong ties and influence within the community (e.g., CERES, CDP, OECD, sustainable and water finance academia, and relevant policy makers), as well as members of the finance community themselves (e.g., water finance consultants, financial institution representatives).

The overall impact intended by the Finance Journey is to shift corporate and private sector water use practices to be more sustainable and employ the valuing water principles when setting water use and management plans and policies.

The rationale in targeting the financial institutions (FIs) is t hat by

a) educating this community on the importance of materiality of water for their core business, b) raising awareness of FIs’ abilities and role to drive the suitability water practices among water users, and

c) providing the FIs with data and guidance on holding their assets responsible to better water use and management, the financial institutions would shift their behaviour in assessing their assets with a stronger water practice lens. This, in turn, is intended to drive behavioural change among the assets and businesses themselves by utilizing better water practices and policies.

Our Finance Journey

The Valuing Water Finance Taskforce

The Valuing Water Finance Taskforce helps drive corporate action on water-related financial risks and engages corporate leaders on sustainable water practices and water risk. The Taskforce raises awareness within the capital markets of the widespread negative impacts of corporate practices on water supplies, as well as to clarify which industries and practices are linked to the most severe and systemic of these impacts. Ceres, together with the Task Force members, will strengthen the financial case for corporate water leadership.

Valuing Water Expectations for Companies

In order to safeguard water resources by preventing the crossing of dangerous ecosystem thresholds or points-of-no-return, investors need to coalesce around a straightforward set of expectations. We will use the Valuing Water Principles to create compelling, easily-communicated and investor-backed expectations for companies so they cannot use complexity to evade responsibility. This will demonstrate how addressing water security builds resilience in investment portfolios and systemically change how financiers contribute to this sector.

Water-related disclosure framework

We will develop and implement a new water-related disclosure framework for financial institutions, beyond the existing Task Force for Climate Related Financial Disclosure (TCFD) recommendations, to ensure investment, insurance, lending, rating and underwriting practices are aligned to help create a water secure future for all. This follows a key recommendation from the United Nations High-Level Panel on Water for financial institutions to improve the disclosure of their investments’ exposure to water-related risks and how their investments may contribute to or mitigate water-related these risks. Using these disclosures, we will score and rank financiers, enabling us to publish benchmarks and highlight best practices, promote leaders and boost ambition amongst laggards. In this way, we aim to introduce new forms of accountability and accelerate action in financial institution towards water-smart financial practices.

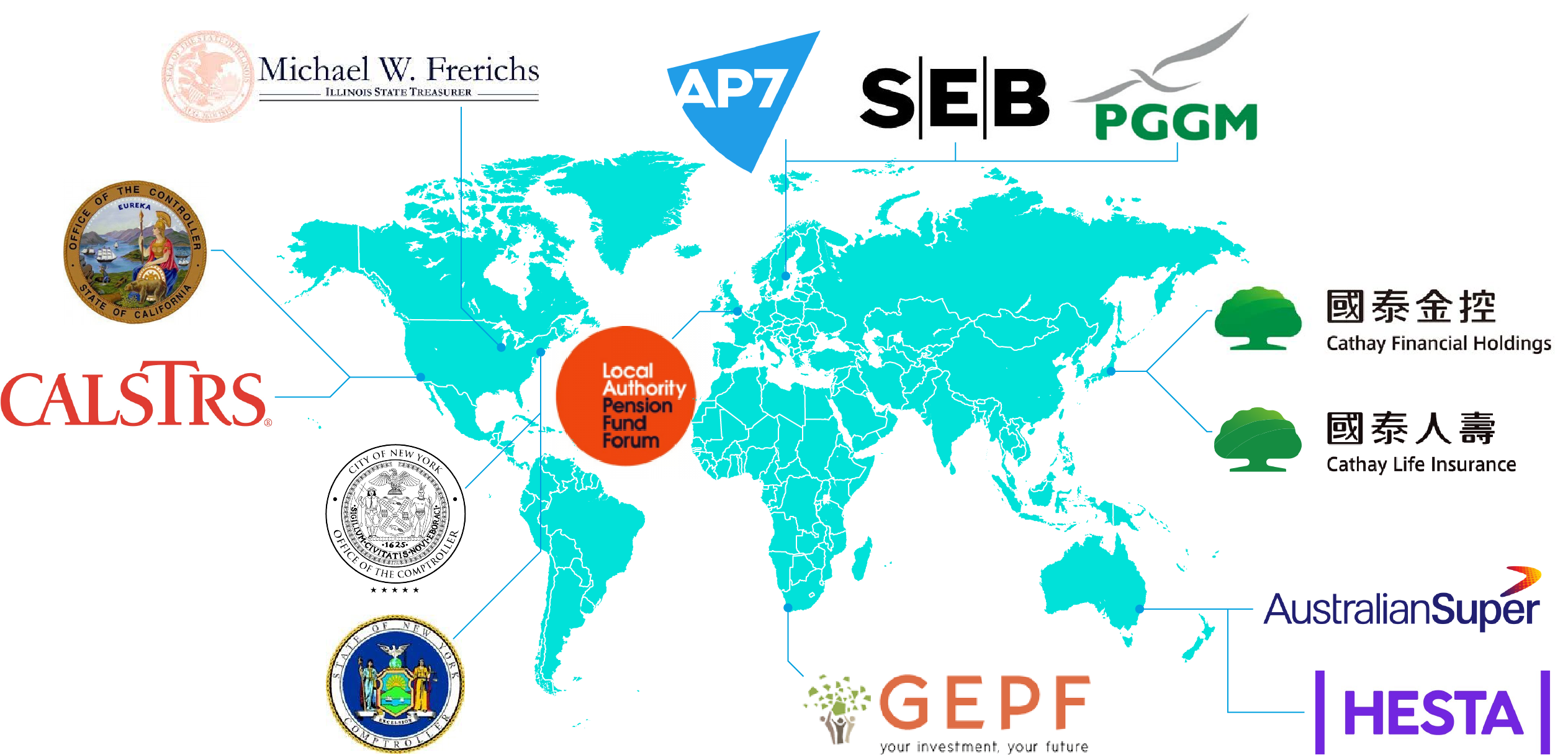

Our Partners