The slim version

A year ago, most people had never heard the word “Ozempic.” Now, the weight loss “wonder drug” and a nearly identical prescription called Wegovy are on the tip of everyone’s tongues. The weekly injectable, initially developed to treat Type 2 diabetes, has been hailed as a “breakthrough,” a “game-changer,” “revolutionary,” and, yes, a “silver bullet” in the battle against obesity. Celebrities love it (though only a few, including Elon Musk, have publicly confirmed they’re using it). Drugmakers do, too. The success of semaglutide—the active ingredient in Ozempic and Wegovy—has “created a gold rush.” In the last year, weight loss drug developers have inked $1.4 billion in deals.

The trouble is, a lot of that money is coming from off-label uses, a totally legal practice in which a doctor prescribes a drug for some purpose other than its FDA-approved one. The US Food and Drug Administration approved semaglutide for patients with a body mass index (BMI) of 30+, or a BMI of 27+ and comorbid conditions. But many insurance companies, including Medicare, don’t reimburse for weight loss drugs. So much of the available medication is being consumed by people with healthy BMIs who can afford to pay out of pocket. While those who need the drug most struggle to access it, for people with deep pockets, semaglutide is “terribly easy to get,” says Jia Tolentino of The New Yorker. No doctor’s appointment required.

Curious how this all began? Here’s your Rx to read ahead.

By the digits

9 million: Number of Ozempic and Wegovy prescriptions US doctors wrote in the last three months of 2022

15%: Average amount of body weight patients lost in a trial studying the maximum dose of Wegovy

66%: Average amount of weight patients regained in the first year after they stopped using Ozempic or Wegovy

$7 billion: Earnings of Danish pharma company Novo Nordisk, who manufactures Wegovy and Ozempic, in the first half of 2023

2.3%: Share of Manhattan’s poshest residents taking Ozempic or Wegovy in 2022

$2.1 trillion: Annual cost it would be to offer every American classified as obese semaglutide at its current price

Explain it like I’m 5!

How does semaglutide work?

It all began back in 1995. Researchers, inspired by the venom of Gila monsters, found that when we eat, our body naturally produces a number of digestive enzymes. The glucagon-like peptide-1, or GLP-1, receptor is one that promotes the production of insulin, slows digestion, and suppresses hunger hormones in the brain.

Semaglutide, the active ingredient in Ozempic and Wegovy, is designed to mimic GLP-1 in the body. In chemistry terms, that makes it a GLP-1 agonist. When people with diabetes take this drug, it serves to make them more sensitive to insulin. It also suppresses a user’s appetite—the reason it’s so popular for weight loss.

Just this week, pharmaceutical giant Eli Lilly announced the results of a clinical trial of a new diabetes drug that’s similar to Ozempic and Wegovy called Mounjaro. In the study, participants on average lost a quarter of their body weight—or a staggering 60 lbs (27kg). Mounjaro combines a GLP-1 agonist with a dupe of another hormone called glucose-dependent insulinotropic polypeptide, or GIP. Together, they seem even more effective than semaglutide. There’s just one catch: This diabetes drug has not yet been FDA-approved for weight loss, though industry insiders believe it will get the all-clear this year.

Quotable

“Being a body-positive doctor in the age of Ozempic has made me realize, sadly, that I alone can’t stop the fatphobia that permeates our culture. As long as it exists, we’ll have a market for medicines that make people thin.”—New Jersey family physician Mara Gordon for NPR

Side effects

Warning: “Power Puking”

Ozempic has been hailed as a miracle drug, but the injectable—did we mention it’s injected, often into the abdomen?—can have serious knock-on consequences. For some users, semaglutide brings about a welcome end to hunger pangs. But for others, the drug induces an intense aversion to food, or even an inability to keep food down. “I had no energy, constant nausea, and what I call power-puking,” Anna Toonk, a diabetes patient and semaglutide user, told The Cut. In fact, appetite suppression is so essential to the drug’s efficacy, some have argued it’s not a side effect at all, but the actual mechanism of weight loss.

Semaglutide and its cousin tirzepatide may also come with an increased risk of thyroid cancer, possible emotional dysregulation, and the threat of too much weight loss. Because researchers only observed trial participants over two years of use, they can’t yet detail all of the pros and cons of the medications. But as semaglutide becomes more popular, the list of possible complications grows. In late September, the FDA updated Ozempic’s label with a new warning—this time, for blocked intestines.

Pop quiz

What is the out-of-pocket cost of a month’s worth of injectable Ozempic?

A. $915

B. $180

C. $525

D. $1,400

Think your chance of being right is slim? Scroll down to the bottom to find out.

Charted

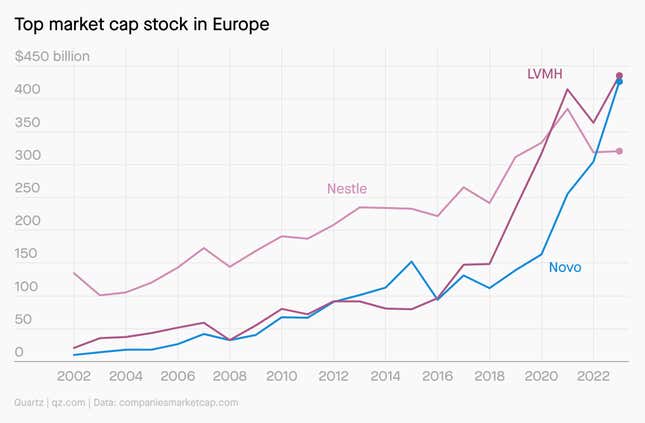

Weight goes down, stocks go up

In September, Danish pharmaceutical company Novo Nordisk briefly overtook LVMH for the largest market cap in Europe, as this graph shows. Novo Nordisk owns the exclusive patent on semaglutide-based drugs Ozempic and Wegovy, meaning all sales flow back to the suburbs of Copenhagen. Though compound pharmacies have tried to mimic the active ingredient, it’s far from the real deal.

Fun fact

At least one of the scientists who developed semaglutide thinks Wegovy and Ozempic will quickly lose their appeal as a weight loss drug. “So you don’t eat through GLP-1 therapy because you’ve lost interest in food,” he told Wired. “That may eventually be a problem, that once you’ve been on this for a year or two, life is so miserably boring that you can’t stand it any longer and you have to go back to your old life.”

Million dollar question

What happens to snacks?

People who take Ozempic and Wegovy often express a change in their appetite. In particular, many eschew high-sugar and high-fat foods while on the drug. That has snack manufacturers looking at their long-term strategies. In a new report, Morgan Stanley estimates that as many as 7% of Americans will be on a GLP-1 drug by 2035. As a result, they predict that “junk food” sales could plummet by 3% or more.

But here’s another factor to consider: The industry “generally over-indexes toward lower-income individuals, who are unlikely to be these drugs’ primary users,” one analyst told CNBC. In other words, cheap, sugary foods are primarily marketed to people who can’t afford Ozempic in the first place—a big link in the whole obesity epidemic to begin with—so soda-makers are unlikely to course-correct too wildly just yet. Despite all the media crystal balling you’re seeing a lot of right now, it’s entirely likely the snack number crunchers will wait. And watch. Wait-watchers.

Take me down this 🐰 hole!

On their podcast Maintenance Phase, Aubrey Gordon and Michael Hobbes deconstruct the diet industry, from the keto diet to the farce that was the Presidential Fitness Test, the scourge of American schoolchildren from the 1950s to 2013. In their latest episode, on Ozempic, the duo discuss the potential life-saving benefits of new weight loss medications—and the urgent need to continue to combat anti-fat bias. For no matter how successful this class of drugs becomes, there will always be a diversity of body sizes in our society.

Poll

Have you tried a drug like Ozempic?

- I have

- I haven’t, but I would

- Nope

Don’t worry, your answer to our one-question poll will be anonymous, and we aren’t in cahoots with Novo Nordisk.

💬 Let’s talk!

In last week’s poll about ETFs, 53% of you said you’d invest in an inverse Elon Musk ETF, while 37% of you would go for an ETF for ETFs, and 10% of you would support an ETF for junk food companies at risk from Ozempic.

🤔 What did you think of today’s email?

💡 What should we obsess over next?

Today’s email was written by Eleanor Cummins (who, for better or worse, will never stop snacking), and edited and produced by Morgan Haefner (who, for better or worse, randomly knows a lot about health insurance).

The correct answer to the pop quiz is A., $915.