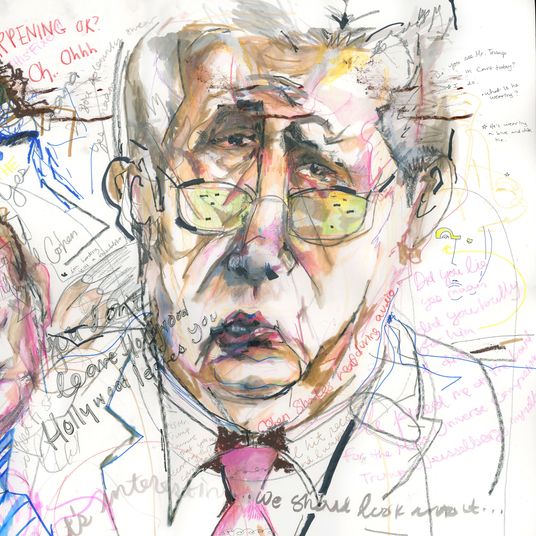

Back in early August, Bill Ackman went full bond vigilante. The CEO of the $16 billion or so hedge fund Pershing Square felt gloomy about the economy and was easily the most prominent among the Wall Street class to declare that the $24 trillion U.S. Treasury market was off the rails and he was going to push it around. This was an end-of-an-empire view of the American situation: rising Chinese labor costs, a spate of union strikes, stubbornly high inflation, Biden’s kamikaze reduction of the strategic petroleum reserves, the end of the “peace dividend.”

The problem, he said, was there was too much borrowing, which made too many bonds to buy, and Wall Street was no longer confident in the value of those future IOUs. As a hedge-fund manager, he made a bet against Treasuries and then watched as the market gradually came to adopt his view. The yields on Treasury bonds, especially those that mature in ten or 30 years, all surged so quickly and so dramatically that it seemed nothing would stop the rise. (For bonds, yields rise as prices fall.) In the end, he was indisputably right and presumably made millions of dollars in profit at the least.

But on Monday, just as ten-year Treasury bonds, one of the most crucial financial instruments on the planet, reached a low not seen since 2007, Ackman had a change of heart. He was short no more. His career as a vigilante lasted less than three months. What exactly changed isn’t so clear — he said there is “too much risk in the world” — certainly true amid a horrible war in Israel and Gaza — and suggested that inflation was starting to ebb. With a string of three spare tweets, totaling 31 words, he sent the bond markets in the exact opposite direction.

Since these tweets, the Treasury markets have rebounded. Consider the whiplash of the 30-year Treasury bond. After Ackman had first posted his August tweet, the yield on those bonds rose by 80 basis points, to 0.8 percent, to a high of 5.11 percent. After he changed his mind, it dropped by 11 basis points, or 0.11 percent, in a single day. These tenths-of-a-percent moves can mean billions of dollars in consequences, especially for the U.S. government, which is refinancing debt at higher rates and, therefore, dedicating more of its budget toward interest payments. What’s more important, though, isn’t the size of the single-day move. After all, in such a large market, not everyone is going to take a single hedge-fund manager’s tweets at face value no matter how often he goes on TV. If proved right, Ackman’s tweets could very well be a high-water mark for the Treasuries markets and ultimately a moment where yields start a longer decline.

The parlor game now is to try to guess how much Ackman made on this bet. Remember, he tends to make gargantuan investments and is generally very good at using the media to move markets in his preferred direction time and time again. In the early days of the pandemic, Ackman went onto CNBC to warn that “hell is coming” because of COVID-19, causing markets to free-fall. Turns out Ackman’s fund had a short bet on the market and made $2.6 billion in about a week. (Of course, he’s also made a series of bad bets over the years, like his short against Herbalife, and Pershing lost money last year.) Still, it’s a trick that keeps on working for him — and is very much not working for any bond traders who haven’t covered their bets. It’s probably not even really worth asking if Ackman ever believed his August tweet. Why anyone would keep believing him after this is a whole other question he needs to consider.